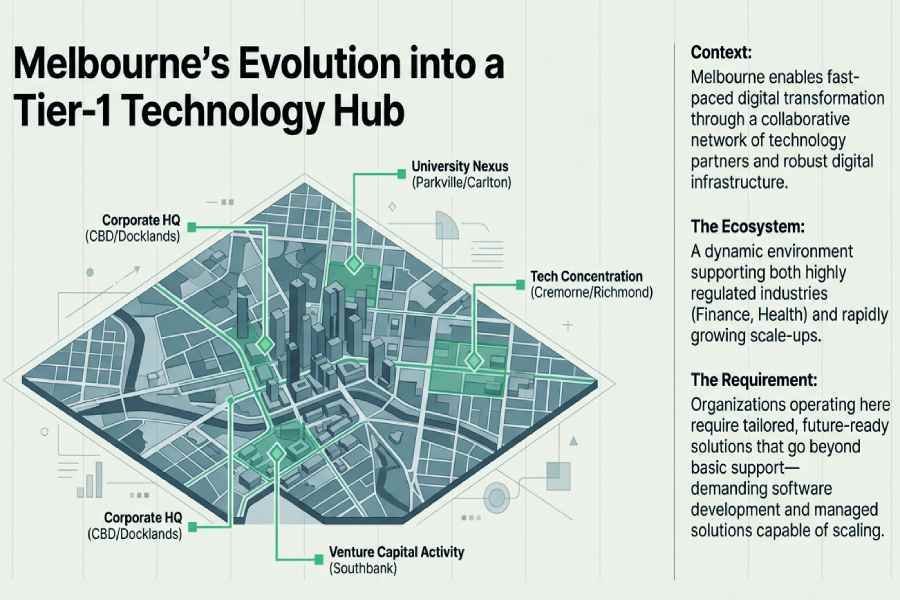

Melbourne has evolved into a leading technology hub, supported by a strong concentration of IT companies, universities, venture capital, and enterprise headquarters. This dynamic ecosystem drives demand for IT services, software development, and managed solutions that can scale across both highly regulated industries and rapidly growing start-ups. With robust digital infrastructure and a collaborative network of technology partners, the city enables fast-paced digital transformation and supports organisations seeking tailored, future-ready solutions.

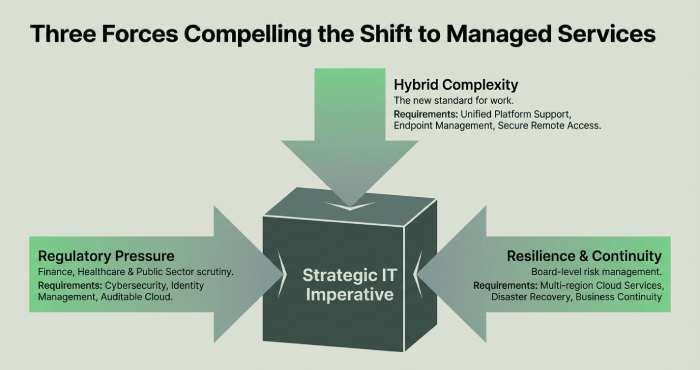

Demand drivers: compliance, hybrid work, and resilience

- Regulatory pressure across finance, healthcare, and the public sector is increasing the need for cybersecurity, identity management, and auditable cloud computing.

- Hybrid working has raised expectations for dependable IT support, endpoint management, and secure remote access delivered through a unified platform.

- Business continuity and disaster recovery, including multi-region cloud services, are now non-negotiable for boards focused on risk management.

Key sectors driving managed services

- Financial services and fintech: enterprise solutions with robust security platform controls, data analytics, and seamless system integration with core banking.

- Healthcare and life sciences: compliance-ready, cloud-native architectures, web applications, and integration services for EMR/EHR systems.

- Retail and e-commerce: web development, e-commerce development, composable commerce through Commercetools, and omnichannel integration.

- Travel, logistics, and events: platforms such as Amadeus, traveller identity management, and real-time Internet of Things telemetry.

- Scale-ups: software development, mobile app development, and AI development supported by cloud computing and DevSecOps.

Service trends shaping MSP offerings

- Cloud-first computing: managed services now standardise on multi-cloud, cloud-native architectures and FinOps, while Microsoft-centric environments remain widely used for Microsoft 365, Azure, and endpoint security.

- Security-led operations: continuous monitoring, zero trust frameworks, and managed detection and response are integrated with compliance reporting.

- Outcome-focused engagements: IT firms in Melbourne align managed services with business outcomes such as workforce management, customer experience, and revenue enablement, rather than simply device volumes.

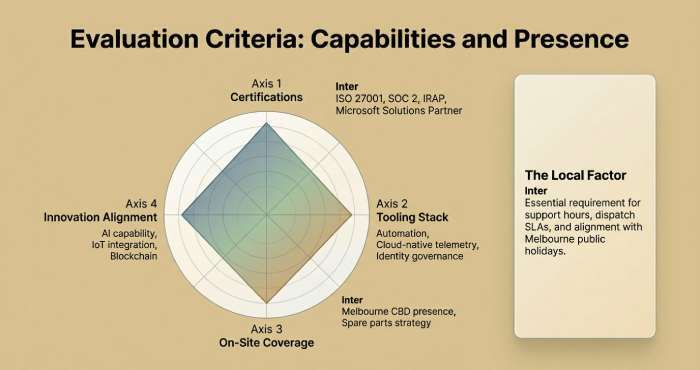

Evaluation criteria for MSPs: services, SLAs, certifications, security, and on-site presence

Defining the scope of IT services

Clearly define which IT services are in scope: end-user IT support; network, server, and endpoint management; cloud services (IaaS, PaaS, and SaaS); backup and disaster recovery; cybersecurity operations; and system integration for line-of-business applications. Also outline expectations for custom software maintenance, web development, and integration services.

SLAs, SLOs, and meaningful reporting

Establish measurable SLAs, including response and restoration times by priority, uptime targets, change windows, and clear escalation pathways. Define SLOs for patch compliance, backup success rates, and security incident MTTR, alongside executive-ready reporting and quarterly consulting reviews to guide ongoing digital transformation.

Certifications, compliance, and technology tools

Look for certifications such as ISO 27001, SOC 2, and ISO 9001, along with sector-specific requirements (including IRAP considerations for government) and vendor competencies (for example, Microsoft Solutions Partner, Dell, IBM, and HCLTech alliances). Confirm that the MSP’s platform stack for RMM/EDR, service desk, and SIEM supports automation, cloud-native telemetry, and identity governance.

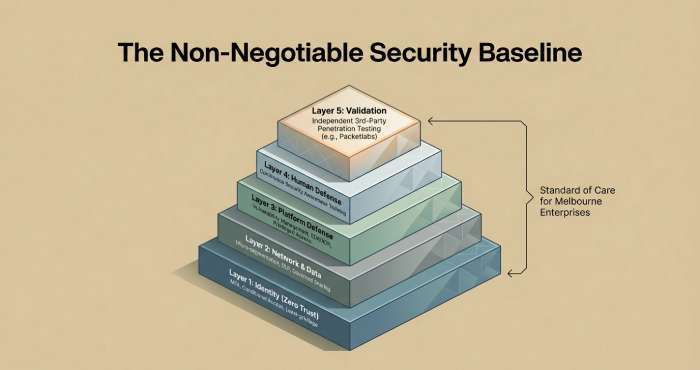

Security by design as a baseline

Require a layered security platform that includes vulnerability management, EDR/XDR, email security, privileged access management, and continuous security awareness. Validate independent third-party penetration testing (with firms such as Packetlabs commonly engaged for impartial assessments) and ensure clear incident response runbooks integrate with your existing platforms and business continuity plans.

Zero trust essentials

- Identity-first controls (multi-factor authentication and conditional access)

- Network micro-segmentation and least-privilege access

- Data loss prevention with governed sharing

On-site coverage and Melbourne-based presence

Even with strong outsourcing in place, Melbourne-based on-site support remains essential for complex hardware issues, executive assistance, and project delivery. Clearly define support hours, dispatch SLAs, spare parts strategy, and change freezes aligned with local public holidays and major events. For multi-site environments, confirm the availability of regional partners and well-defined after-hours support procedures.

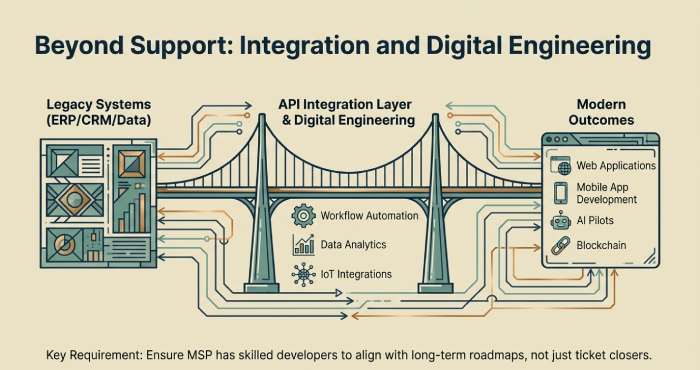

Architecture, integration, and innovation alignment

Evaluate the MSP’s capability to deliver custom solutions and system integration across ERP and CRM platforms, data analytics environments, and workflow automation. Review their track record in AI development, blockchain pilots, Internet of Things integrations, and modern DevOps practices for web applications and mobile app development. Ensure they have a skilled team of developers and industry specialists who can align with your project requirements and long-term roadmap.

Snapshot of leading Melbourne providers: strengths, specialisations, and ideal client profiles

Global MSPs and consultancies operating in Australia (IBM, NTT Data, HCLTech, Capgemini, Wipro)

- Strengths: enterprise-grade solutions, large-scale managed services, complex system integration, and delivery within regulated industries.

- Ideal for: mid-market to enterprise organisations seeking end-to-end IT services, digital transformation initiatives, and multi-year outsourcing arrangements.

Cloud and endpoint leaders (Microsoft, Dell)

- Strengths: cloud computing and cloud services (Azure, Microsoft 365), device lifecycle management, security hardening, identity management, and the modern workplace.

- Ideal for: organisations standardising on Microsoft platforms and seeking to consolidate endpoint management, collaboration, and security.

Digital engineering and custom software partners (Fingent, Hyperlink InfoSystem)

- Strengths: custom software development, web development, mobile app development, and integration services that support composable technology solutions.

- Ideal for: scale-ups and mid-market organisations requiring rapid product delivery with a consulting partner aligned to business outcomes.

Commerce and composable ecosystems (Commercetools)

- Strengths: a headless commerce platform that enables e-commerce development, system integration with ERP and CRM systems, and cloud-native scalability.

- Ideal for: retailers and brands pursuing omnichannel and API-first digital services with Melbourne-based implementation partners.

Independent cyber security specialists (Packetlabs)

- Strengths: offensive security testing, red teaming, and security assurance that complement MSP-operated blue teams.

- Ideal for: organisations seeking independent validation of their cybersecurity posture and the effectiveness of security controls.

Sector platforms and the local ecosystem (Amadeus, Auror, Linktree)

- Strengths: Amadeus for travel industry operations; Auror for retail loss prevention intelligence; and Linktree as a Melbourne-born platform showcasing the city’s technology hub credentials.

- Ideal for: sector-aligned integrations where MSPs manage infrastructure, security, and system integration around these platforms.

Emerging and boutique providers (including Probey Services)

- Strengths: focused managed services and tailored IT support; ensure coverage, references, and certifications are validated for Melbourne operations.

- Ideal for: small to medium-sized businesses requiring hands-on engagement and faster change cycles, supported by clear SLAs and transparent pricing.

Pricing and ROI: common models, hidden costs, and benchmarking proposals

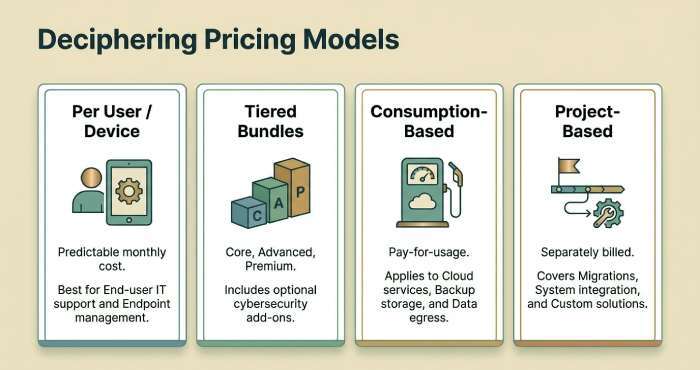

Common pricing models in managed services

- Per user or per device: predictable pricing for end-user IT services and endpoint management.

- Tiered bundles: core, advanced, and premium managed services with optional cybersecurity add-ons.

- Consumption-based: cloud services, backup storage, and data egress aligned with actual usage.

- Project-based: migrations, system integration, and custom solutions billed separately.

Hidden costs to identify early

- After-hours and on-site dispatch fees across the Melbourne CBD compared with suburban locations

- Premium licensing for EDR/SIEM, identity governance, and advanced data analytics

- Cloud egress charges, backup retrieval, and cross-region replication

- Onboarding, discovery, documentation, and knowledge transfer activities

- Out-of-scope requests related to web applications, e-commerce development, or legacy system remediation

Benchmarking and value realisation

Develop a like-for-like comparison matrix covering SLA tiers, security controls, staffing ratios, automation maturity, and consulting cadence. Link return on investment to fewer incidents, faster MTTR, accelerated software development releases, improved workforce management productivity, and reduced risk exposure. Compare two to three proposals against internal baselines and reference architectures validated by industry experts.

Selection and onboarding: RFP checklist, due diligence, and a practical 90-day transition plan

RFP checklist for Melbourne organisations

- Business outcomes: digital transformation goals, regulatory requirements, and strategic marketing alignment with martech platforms

- Scope and interfaces: IT support, cloud computing, cybersecurity, and integration services, with clearly defined handover points

- Tooling and platform standards: ticketing systems, RMM/EDR/SIEM, backup, automation, and reporting

- Certifications and references: ISO and SOC certifications, Melbourne or ANZ-based references, and technology partners (such as IBM, Microsoft, Dell, Capgemini, NTT Data, Wipro, and HCLTech)

- Security requirements: zero trust, identity management, incident response, and independent third-party testing

- Transition plan: asset discovery, CMDB development, documentation, and shadow support

- Commercials: service tiers, rate cards, change management processes, and exit provisions

Due diligence and risk assessments

Conduct architectural and security reviews; verify insurance cover, financial stability, and staffing depth; assess real-time dashboards and operational runbooks; and complete reference checks. Confirm the team of developers and architects can meet project requirements for custom software, cloud-native modernisation, data analytics, and integration with legacy platforms.

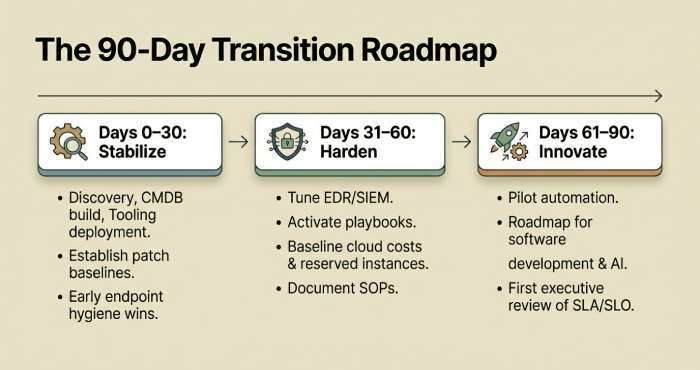

A practical 90-day transition plan

Days 0–30: Discovery and stabilisation

- Contract commencement, asset discovery, CMDB development, and tooling deployment

- Identity management hardening, patch baseline establishment, and backup verification

- Early improvements in IT support and endpoint hygiene

Days 31–60: Harden and optimise

- Security platform tuning (EDR and SIEM), playbook activation, and ongoing monitoring

- Cloud services cost baselining, reserved instance planning, and right-sizing

- Documented SOPs for changes, incidents, and system integration

Days 61–90: Innovate and measure

- Pilot automation for joiners, movers, and leavers, along with workflow integrations

- A roadmap for software development improvements and AI development use cases

- Executive review covering SLA and SLO performance, risk reduction, and next-quarter outcomes for Melbourne stakeholders